EXCEPTIONAL SERVICE

We are experienced and certified Military Relocation Professional (MRP). With deep expertise in PCS moves and VA benefits, we provide a seamless, real estate experience.

ADDITIONAL SAVINGS

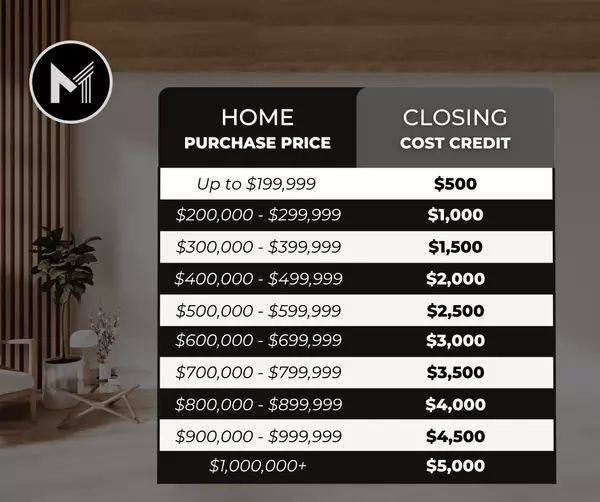

INTRODUCING OUR NEW MILITARY AND VETERAN SALUTE PROGRAM (MVSP): UP TO $5,000 IN CLOSING COST CREDIT

To further honor our service members, The Mejia Team is proud to introduce the "Military & Veterans Salute Program." Under the MVSP initiative, we offer an exclusive closing cost credit, up to $5,000, for our military and veteran clients. This is our way of saying thank you for your service and making your dream of home ownership in the South Florida real estate market a reality. Your sacrifice for our nation deserves to be rewarded, and we are here to assist you every step of the way.

The chart on the left (view full size) display the closing cost credit you will receive depending on your home purchase price. Please note that the closing cost credit may change when purchasing a for sale by owner, new construction homes, or reduced commissions for buyer's agents.

GETTING STARTED WITH VA LOANS

VA Loans are mortgage option provided by lenders but guaranteed by the Veterans Affairs Department. They assist veterans, active-duty military personnel, and eligible surviving spouses in achieving their homeownership goals.

VA Loans have a host of benefits. For starters, they offer some of the best interest rates in the market. Additionally, they usually don't require downpayment or private mortgage insurance (PMI), and in comparison to conventional loans that mandate strict credit score and income criteria, VA loans impose more accommodating qualification standards.

Qualifying for a VA loan necessitates meeting service requirements as a Veteran, active-duty member, or surviving spouse. A certificate of eligibility (COE) from the VA, which verifies the applicant’s service status and length, is required. As long as the individual has a DD-214 document showing honorable discharge, they are likely eligible.

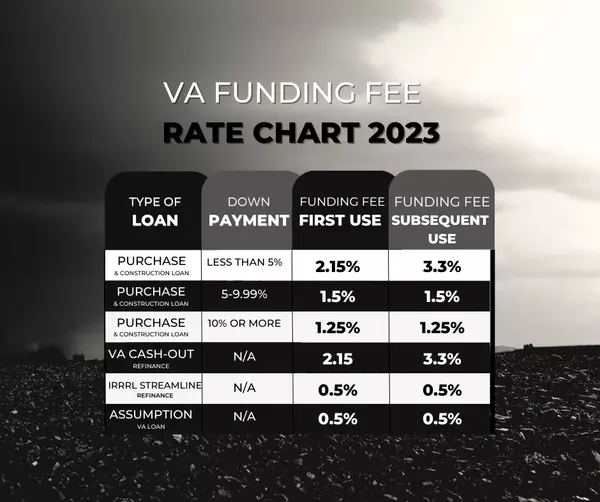

UNDERSTANDING THE ESSENCE OF THE VA LOAN FUNDING FEE

The VA funding fee is waived for veterans with a VA 10% service-connected disability rating, active-duty service members with a Purple Heart, and surviving spouses of a veteran who died in service or from a service-connected disability.

The VA funding fee can be financed into the loan amount, providing flexibility to the borrowers. However, all other fees must be settled in cash at closing.

OTHER LOAN CLOSING COSTS

Beyond the VA funding fee, borrowers also need to be aware of other closing fees. These other closing fees for VA Loans include origination fee, discount points, credit report fee, appraisal fee, insurance and taxes, title insurance, recording fee, and others. Understanding all these fees can provide you with a clear picture of what the entire home buying process will cost. This can help you prepare your finances accordingly and avoid any unexpected expenses when you're ready to finalize your home purchase.

MIAMI-DADE & BROWARD COUNTY PROPERTY TAX EXEMPTION FOR VETERANS

Florida law offers valuable property tax relief for those who have honorably served in the United States military.

Homesteaded property can be exempted from all ad valorem taxes for Veterans who have been honorably discharged from the military and have sustained a "service-related total and permanent disability.

Veterans with a service-connected disability of 10 percent can reduce the assessed value of a homesteaded property by $5,000.

In order to qualify, the veteran must

- Be a permanent resident of Florida as of January 1, the year they applies

- Have a homestead exemption

- Have received an honorable discharge from the military

- Have sustained a service-connected disability

First-time veterans applying for homestead exemptions must submit a Homestead Exemption Application before March 1 and include a letter from the Veterans Administration (VA) certifying service-connected total and permanent disability or a copy of their VA form 27-333, which would serve as proof of disability.

An exemption is also available to the widow or widower of a service member who died as a result of a service-connected disability or while serving in the military.

March 1st is the deadline for all property tax exemption applications.

Contact us today to learn more about this benefit!

What is a VA loan, and how does it work?

A VA loan is a mortgage loan available to veterans and active service members. It offers favorable terms, including no down payment, no mortgage insurance, and more.

Can a surviving spouse of a veteran apply for a VA loan?

Yes, under certain conditions. Surviving spouses of veterans who died on active duty or from a service-related disability may be eligible for VA loan benefits.

Can National Guard members and reservists apply for VA loans?

Yes, National Guard members and reservists are eligible for VA loans. They need six years of service in the Selected Reserve or National Guard, or they must have been called to active duty for a certain period.

How is the VA funding fee calculated?

The VA funding fee is a percentage of the loan amount, and it varies based on the type of service, the type of loan, whether you've used a VA loan before, and the amount of your down payment.

Can the VA funding fee be waived?

Yes, the funding fee can be waived for veterans who receive VA disability compensation, surviving spouses of veterans who died in service or from service-related disabilities, and active-duty service members who have received a Purple Heart.

Can I roll the VA funding fee into my loan?

Yes, the VA allows borrowers to include the funding fee within their overall loan amount.

Is the VA funding fee tax-deductible?

Yes, the VA funding fee can be included in your mortgage interest deduction on your income taxes, but always consult with a tax advisor.

Who pays the closing costs on a VA loan?

Typically, the buyer pays for the closing costs, but they can sometimes be paid by the seller or included in the loan amount.